U.S. Treasury Ten Year Note

Interest Rate Graph 1953 to 2014

Best Fit Regression Curve, Log-Trig Mathematical Model

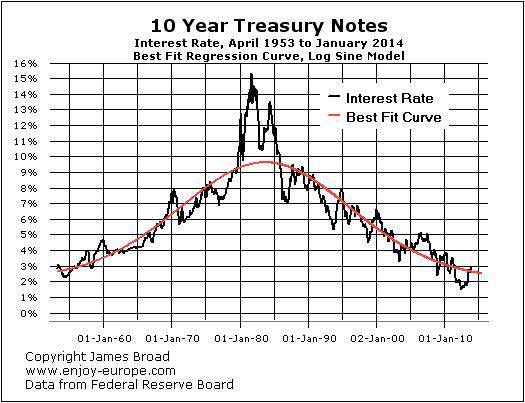

This graph plots the Ten Year U.S. Treasury Note interest rate going back to 1953. That is the irregular saw-tooth black part of the graph. I have run a regression analysis of this data using a combination logarithmic and trignometric mathematical model. The result is a log-sine wave for this period of time, the red line, which is extended to January 2015.

Carpe diem. Vivere bene! Gratia Deo.

This essay was originally published January 6, 2014.

Data and graphs have been updated to August 12, 2016 at U.S. Treasury Notes. Interest Rates.

Appendix: Interest Rates

HOW TO EUROPE:

The Complete Travelers Handbook

John Bermont

This entire book is published totally free on-line by the author, photographer, and webmaster, yours truly, with help from my daughter Stephanie. I welcome all questions, comments, compliments, and complaints. For contact information please see NOTE TO READERS.

It's a crap shoot.

WHAT IS A TREASURY NOTE?

The Ten Year U.S. Treasury Note, or "T-Note" for short, is a debt instrument similar to a bond. They finance the government for the difference between tax revenue and spending. Bonds and Notes are issued periodically by the US Treasury Department at a fixed interest rate. After issuance they are bought and sold in futures markets at free market prices by open bid. The price moves up and down daily, even by the minute. As the price of the T-Note moves up or down the interest rate moves in the opposite direction.

This interest rate is a key parameter for the economy.

FUTURES AND OPTIONS

T-Notes are traded on the Chicago Mercantile Exchange, the "CME" for short. This is a successor to the Chicago Board of Trade, "CBOT" for short. The CBOT is famous for the number of commodities and dollar value traded every day. It is best known for soybeans and pork bellies, also known as beans and bacon.

I've traded futures and options for many years, and have actually made money a few times on speculative positions. I have risked my hard earned treasure on everything from live pigs to gold to Deutschmarks on the Chicago markets. For the past 15 years I have focused on US Treasury debt products, specifically the T-Note.

Noise Reduction

Many economists (I am not an economist) like to calculate a moving average of non-eurythmic data such as daily interest rates to get a better idea of the general trend. A moving average takes noise out of the data and results in a smooth curve similar to the red line you see in the graph above. However, my curve is not a moving average. It is a least squares regression of the data. The mathematical model for the regression is a combination logarithmic and trigonometric algorithm. The result has a correlation coefficient of 87.6%.

Why do I do a regression instead of a moving average? Because the regression result is an algebraic equation which is sometimes suitable for prognostication. Remember algebra from high school? It goes something like Y=A+BX, where Y is what you are looking for. It is often shown as f(X), meaning function of X. A is a constant, B is a coefficient, and X is an independent variable. X can be anything, any combination of observed or manufactured data that you want it to be. Works for me.

OUR SORRY FUTURE

Quantitative Easing

Where or why the term "quantitative easing," "QE" for short, was invented is beyond me. It is probably a spin phrase crafted after somebody at the Treasury Department had six vodkas, the cost of which landed on an expense report which was ultimately paid for by the taxpayer, or will be paid for by our grandchildren. The clever newspeak manipulator is probably still laughing.

As you can see in the "10 Year Treasury Notes" graph above, this key interest rate was already close to historic lows before the Federal Reserve Bank, the "Fed" for short, started buying US soverign debt right after the election in late 2008. The theory is that since free market low interest rates had not stimulated the economy, enough if at all, the Fed must then shovel more cash into the system in the hope that it starts circulating and improving the economy. It probably did — in communist China and on Wall Street — but not on Main Street USA.

So what did the Fed do about that? They went ahead with another QE to show the damn sluggish USA economy that they mean business. Main Street started cracking up, but not in laughter. So the Fed went for strike three. Another swing and a miss. In baseball you are out. Einstein is cited as giving us the definition of insanity: "Insanity is doing the same thing over and over again and expecting different results." After QE-1, QE-2, and QE-3 the Fed should be in a straight jacket in a padded cell.

Meanwhile widows and retirees with their life savings in Certificates of Deposit, "CDs" for short, are seeing their income go down even further every time they roll over their maturing CDs for new ones.

An Elegant Ponzi Scheme

The U.S. Securities and Exchange Commission, "SEC" for short, defines Ponzi scheme as:

A Ponzi scheme is an investment fraud that involves the payment of purported returns to existing investors from funds contributed by new investors.

The Fed doesn't have "existing investors" as such nor did it need to go to the inconvenience of finding "new investors." The Fed just arbitrarily granted itself more credit to get the cash for this buying program. In effect they wrote a check payable to "cash" when they had nothing in the bank. Most people go to jail for this, but not the Fed. The Fed is called a hero because it has everybody believing that it saved the economy. This insanity-on-steroids Ponzi scheme will probably doom itself and ruin the economy. The only scenerio which could save the Fed is a massive increase in non-government employment along with a surge in taxable wages.

History Redux

History is filled with civilizations which bankrupted themselves. Back in the good old days the king would melt gun shot with the gold and debase the coinage. Nowadays the Fed Chair does it with the prick of a computer button.

The soverign debt of Greece and the other PIGS nations (Portugal, Italy, Greece, and Spain) nearly wiped out the common European currency, the euro, in 2012. The USA debt of $17 trillion, over $50,000 per man, woman, and child, is growing at a trillion dollars a year. Politicians are not schooled in economics. They should stay away from the public treasury, but that would be more difficult than keeping children out of the cookie jar. Bottom line: good-bye USA.

The Picture

Short memory is a human weakness. The fact is that interest rates have been scraping bottom for a generation. Financial commentators love to shout themselves silly whenever there is any sign that rates could go up a tenth of a notch. Most of them were still in high school a generation ago. Then they went to journalism media school and learned how to read script for the local news. Most of them are meat heads.

Put it all into perspective with the following picture.

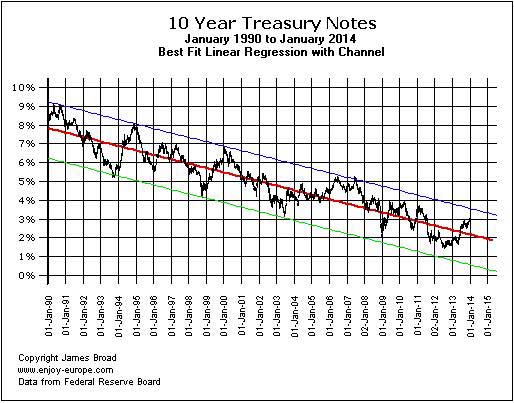

Here is another graph showing interest rates in more detail for the past 23 years, January 1990 to January 4, 2014. All of the data fits nicely in the channel of two lines parallel to the straight line product of a linear regression. The extension of the best fit linear equation takes the rate down to 2% by January 2015. Why would the rate go that low? Any number of reasons could bring this on, from a sputtering US economy to foreigners trying to ditch their own wampum. Got a suitcase?

A POORLY KEPT SECRET

A New Word in the Financial Lexicon

Yup, just when you think you know how to speak English they throw a new word into it. The word of the year is "taper." It is a noun and a verb. Only the Fed can do it. All others must wait and watch.

As a definition you might use:

taper:

v. to reduce the amount of US Government debt purchased by the Fed.

n. the act of tapering.

I don't think that they needed this word. They are probably laughing about it. If they were honest they would have spelled it right and called it tampering, not tapering. The Fed jokester are probably amazed that they can get away with this newspeak. Well, the journalists are simply paid to read the script, not to think or anything like that. Trying to analyze this stuff would probably fry the fat between their ears.

Buy the Rumor

The whole world already knows what the Fed will do to interest rates in 2014. The news has been out for months. The Fed will taper. Why will they do that? Because they said so. What effect will it have on anything? That is the billion dollar question. Common consensus is that the result will be an increase in interest rates.

My consensus is that it will have little effect on anything. Everybody already knows it will happen so the change in interest rates has already taken place. People trade on future expectations, not on history. The Fed intention was broadcast with a drum roll in May 2013. Bond prices took a dive and interest rates started going up. In the months since then the interest rate has gone up by about 1.5%. That's about the amount it went down when the Fed began actively buying debt back in 2008.

As they say in the market, "buy the rumor - sell the news." I say the show is over. Hold up the applause card.

ADVANCE TO GO

Now you can visit the real purpose of my web site, independent budget travel. If you are thinking of going to Europe go to enjoy-europe.com first.

Have a good trip!

NOTE TO READERS

This page of my web site has nothing to do with travel in Europe. The study of economics and mathematical modeling is one of my "extracurricular activities." Rather than start a tiny new web site on the subject I have slipped this essay in with my travel information.

My email address is [email protected].

FREE

This web site is totally free for everyone, and a labor of love for me. To keep it afloat I receive a commission from Amazon.com for all goods purchased through the adverts I have selected, and any other products you might buy when you are on the Amazon site. Amazon has almost everything for sale, except the Brooklyn Bridge, Mount Rushmore, and some other monuments that you probably do not need at home or abroad anyway.

Please visit my on-line store at

.

Your support is most gratefully appreciated. TIA.

.

Your support is most gratefully appreciated. TIA.

To like and like not:

Adverts

To support this site:

Please buy your goods at:Amazon.com

Shop in your shorts!

Please clean out your cookie jar before clicking.

Here are a few books from the professionals.

My friend from college days, Harry Veryser, published his book last year with excellent reviews from the leading libertarians. It Didn't Have to Be This Way:

It Didn't Have to Be This Way:Why Boom and Bust Is Unnecessary — and How the Austrian School of Economics Breaks the Cycle

by Harry C. Veryser

The Master, von Mises.

Human Action:

Human Action:A Treatise on Economics

by Ludwig Von Mises

This is the spearhead against socialism.

The Road to Serfdom: Text and Documents — The Definitive Edition (The Collected Works of F. A. Hayek, Volume 2)

The Road to Serfdom: Text and Documents — The Definitive Edition (The Collected Works of F. A. Hayek, Volume 2)

The Law was originally published in French in 1850 by Frederic Bastiat.

The Law by Frederic Bastiat.

The Law by Frederic Bastiat.

This is an easy to read economics primer.

Economics in One Lesson: The Shortest and Surest Way to Understand Basic Economics by Henry Hazlitt.

Economics in One Lesson: The Shortest and Surest Way to Understand Basic Economics by Henry Hazlitt.

Who is John Galt?

My all-time favorite book. Atlas Shrugged

Atlas ShruggedAyn Rand

The links in this pink field take you directly to a page at Amazon.com. The Amazon page details the item, and in most cases includes candid and critical comments from others who have bought the item.

Amazon pays my site a small commission when you click and order an item, if you put it in your shopping cart within 24 hours based on the cookie they set on your computer. If you don't want to make a quick decision just put it in your shopping cart, think it over, and come back later. The revenue covers the cost of maintaining this web site and keeps it free to users.

You benefit when buying here because Amazon has:

- 20% - 30% discount on many items,

- free shipping deals, direct to your door,

- no sales tax on Internet purchases in most states,

- zillions of products, well almost,

- fast delivery even when it is free,

- shipment tracking in UPS, USPS, FedEx,

- easy returns if you are not happy with the product.

You win we win.

Thanks for your support!!

Have a good trip in life,

John Bermont

Note: Italicized notations by the author.